The Holy GRAIL Opportunity $GRAL

An asymmetric risk/reward biotech company with the potential to revolutionize the Multi Cancer Early Detection (MCED) industry

Thesis

The large cash position protects the downside risk of Grail. Approval from NHS or FDA would trigger a parabolic re-rating.

NHS has $1 billion in pre-orders as stated in their contracts if the current trials met their expectation.

FDA approval would give Grail’s Galleri test the reimbursement from Insurance companies.

As of Q3 2024 (ending Sep 30 2024), Grail has $853mm in cash and $72mm in operating lease liabilities, giving it a net cash balance of $781mm. From what management has guided in Q2 2024, this 2nd half of 2024 will incur a cash burn of $220-250mm and $325mm in 2025, starting from an initial net cash position of $882.8mm ($958.8mm Cash - $76mm operating lease liabilities = $882.8mm). So for Q3, the cash burn was $882.8mm - $781mm= ~$102mm. Management is currently on track for what they previously guided. So our expected cash burn forward is $110mm + $325mm = $435mm.

This gives us a remaining cash position of $781mm -$435mm = $346mm by the end of 2025. With 31mm shares outstanding, this gives us an ending $11.16 cash per share. At the current share price of $14.80, this downside scenario represents as ~25% downside case.

How Galleri works

As stated on their website, the idea for GRAIL first started when Illumina was able to detects circulating tumour DNA (ctDNA) in patients that were not diagnosed. The Galleri Test “identifies DNA in the bloodstream shed by cancer cells and screens for signal shared by multiple cancers at time of testing”.

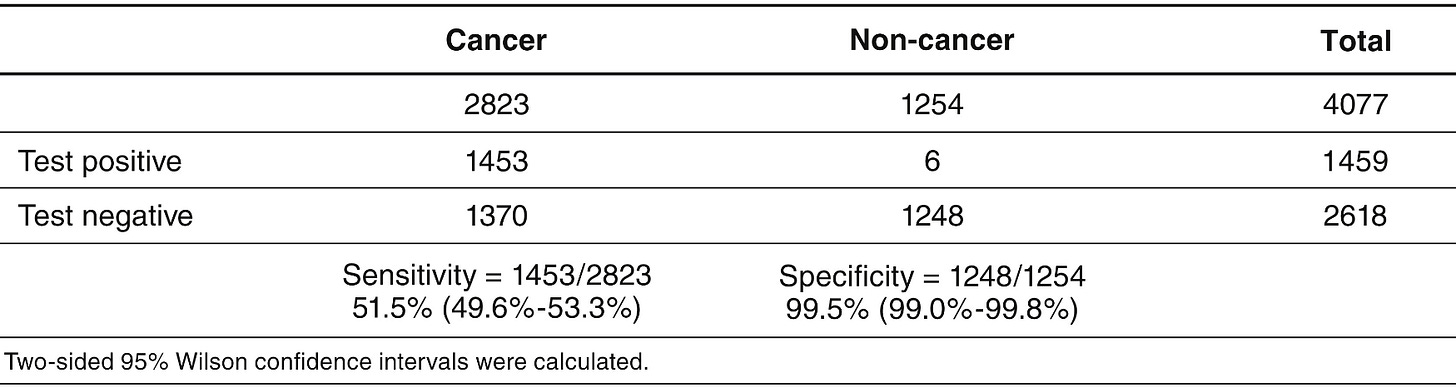

A CCGA study published in the ESMO stated that the evidence suggests Specificity for cancer signal detection was 99.5%.

Overall sensitivity for cancer signal detection was 51.5% (49.6% to 53.3%)

Stage 1 sensitivity: 16.8% (14.5% to 19.5%)

Stage 2 sensitivity: 40.4% (36.8% to 44.1%)

Stage 3: 77.0% (73.4% to 80.3%)

Stage 4: 90.1% (87.5% to 92.2%)

Stage I-III sensitivity was 67.6% (64.4% to 70.6%) in 12 pre-specified cancers that account for approximately two-thirds of annual USA cancer deaths and was 40.7% (38.7% to 42.9%) in all cancers

Cancer signals were detected across >50 cancer types.

Overall accuracy of Cancer Signal Origin prediction in true positives was 88.7% (87.0% to 90.2%) —> Grail can indicate where the cancer is from

In another study, accurate diagnosis was achieved in “less than three months (median 79 days) among participants who received a cancer signal detected result” (Cancer Diagnosis speed data is from a different study - PATHFINDER)

For this experiment Positive predictive power (PPV) = 1453/(1453+6)= 99.59% —> If the Galleri test says you have cancer, you probably have it

NOTE: This population used has 2823/4077= 69.2% cancer population. So it can be considered to be skewed. It is not representative of a normal population

In the early stages of cancer (1 & 2), Galleri was able to detect (143+284)/(849+703)=27.51% of all cancers

I am not a biology expert and from I read online, some people think this is an abysmal sensitivity rate. Compared to single cancer detection kits, i think MCEDs are bound to have a lower sensitivity. What MCEDs give up in depth, it gains in range. Galleri is claimed to be able to detect over 50 different cancers. I don’t think any normal patient is going to take 50 different single cancer detection kits.

Economics of MCED

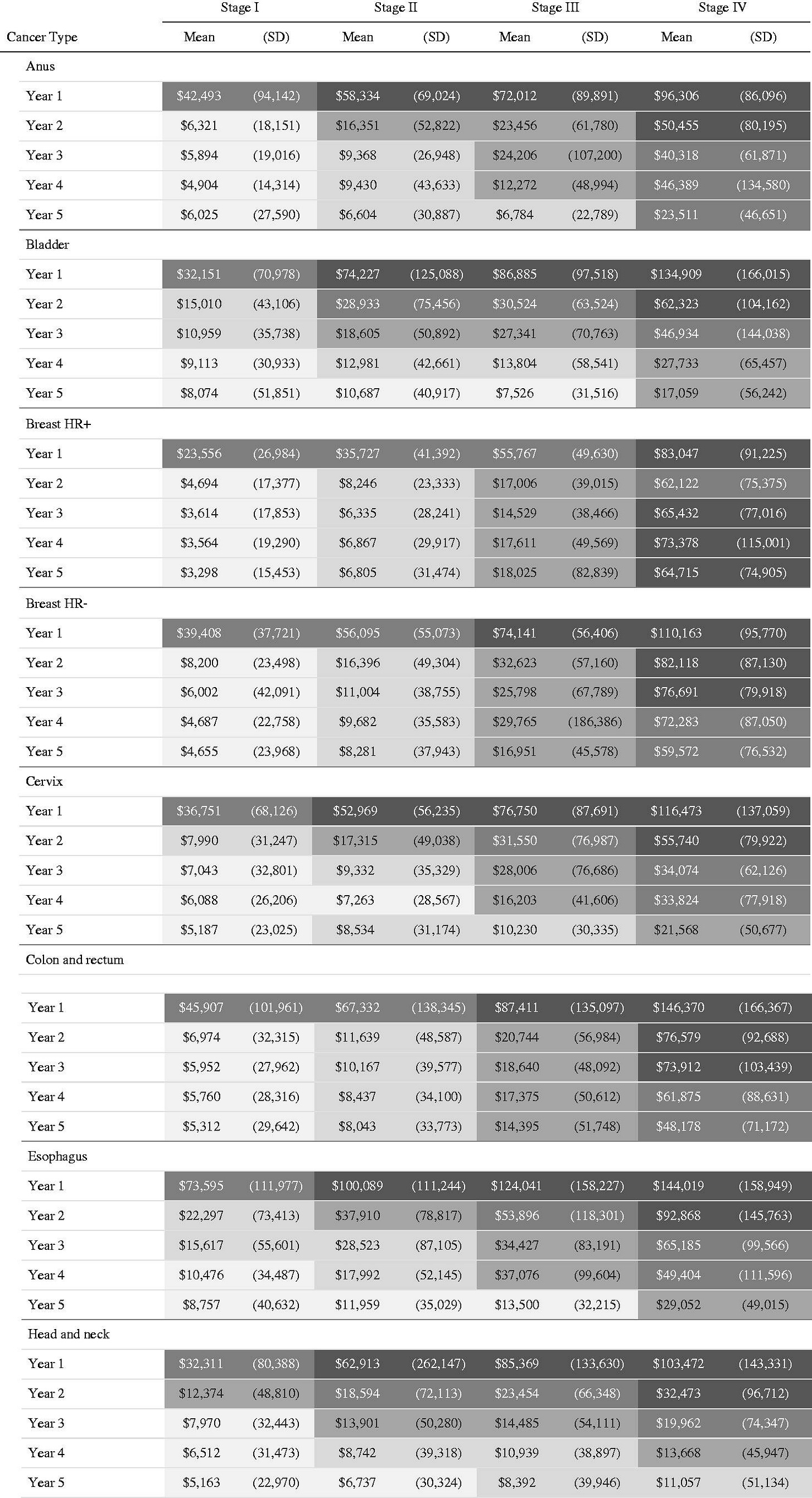

Cost to treat cancer grows as the stage progresses.

Cost of cancer also remains high for many years after diagnosis, especially for late-stage cancers.

Currently according to NHS, half of all cancers (54%) discovered at early stage (1&2) compared.

This is the data from BMC Health services.

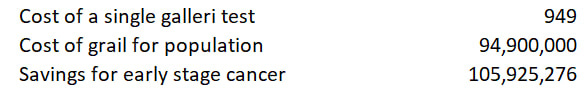

So, on average, i would save roughly $410k per early-stage cancer patient I discover that would have been a late-stage cancer patient. I made some rough assumptions in my %.

Links: Cancer Discovered

These numbers are, of course, flawed due to my many assumptions in the calculations. There are also additional costs in sending the false positive people for extra screening and additional saving by identifying stage 3 cancer before it progresses to stage 4. But, for the sake of simplicity, I decided to just look at if we were to the additional early stage cancers that we can detect. This scenario is just to show that we can achieve an NPV positive return on the implementation of the Galleri Test. I also have not include the net social benefit of early detection - more lives saved.

NHS-Galleri Trial

Here are some details regarding

‘Originally proposed as a pilot, the project was fortunately revised into a randomised trial of 140 000 individuals to run from 2021 to 2024. Of subsequent concern was the announcement in mid-2023 that “if early trial results are promising”, during 2024–26 the NHS will use 1 million more tests “to assess the test as a screening tool at scale.“‘

Source: The Lancet

More information for the trial can be found here

In May data, NHS decided that they could not accelerate the trial to run the pilot program solely based on the preliminary data.

“Committing to accelerate implementation of the test in the NHS at scale would have been an exceptional step, requiring exceptional data after just one year, and while what we have seen is very promising, the data so far do not support moving at such a fast pace.”

Source: NHS

“Three robust, ambitious and pre-specified criteria were assessed: the positive predictive value (PPV) of the Galleri test, the number of late-stage cancers detected and the total number of cancers detected in the intervention arm compared with the control arm. Notably, this was not an interim analysis of the trial primary endpoint, as that analysis requires data from all three rounds of screening.

Based on a snapshot of first-year results from the ongoing NHS-Galleri trial, NHS England has decided to await final results from the three-year trial before determining whether to initiate a pilot of the Galleri test in the NHS.

Advised by a multidisciplinary expert panel, NHS England determined that, while the early analysis showed that the assessed clinical performance of Galleri was very promising — consistent with or better than Galleri’s clinical performance observed in previous published studies — there is not yet enough early compelling evidence to accelerate implementation through a pilot programme at this stage.”

Source: Grail

FDA Approval

Grail receive FDA’s Investigational Device Exemption (IDE) for all their clinical studies in the US: REACH, Pathfinder, Pathfinder 2.

Now, Grail currently waiting for FDA’s Pre-Market Approval (PMA)

“So we're now in July, completed the study visits for our 2 key registrational studies. So PATHFINDER 2, where we've enrolled 35,000 people, and the NHS-Galleri study were enrolled 140,000 people in that. That's the clinical data across that 175,000 people, where we will use to submit for our PMA and the submission time is the first half -- first half of 2026. And so from that, we do expect an advisory committee at the FDA. And so we expect about a 1-year time line from that, which would drive us into first half 2027 for FDA approval, is the tentative time line that we're working towards.” - Robert Ragusa, CEO, Q3 2024 Transcript

FDA approval will allow for broad insurance reimbursement.

In addition to insurance, FDA PMA approval will be needed in order for Grail’s Galleri Test to be covered by the upcoming Medicare Multi-Cancer Early Detection (MCED) Screening Coverage Act.

Competitors

Currently, the main competitor for Galleri is Exact Sciences. Exact Science only began their first population study in Aug 2024.

“Up to 25,000 patients ages 50-80 with no history of cancer will participate in annual MCED testing for three years and two additional years of follow-up data collection”

This study will finish by 2028-2029

Their clinical data shows that their MCED test is more sensitive that Grail’s Galleri Test at early-stages, but we will have to wait for the population study to be more certain.

Overall, Grail has the first mover advantage over Exact Sciences.

Valuation

Currently, Grail has about ~118mm in Revenue. Consensus revenue estimates for 2025 is 138mm. At the current market cap of $500mm, Grail trades at 3.6x Forward P/ 2025E Sales.

In the upside scenario, where NHS orders 1m Galleri Test kits over 5 years (200k annual). That would mean an additional ~200mm revenue in 2027. Grail’s 2027E revenue is ~170mm without NHS. Upside 2027 Revenue —> 170mm + 200mm = 370mm

At 3.6x P/S, Grail’s market cap would be 370mm*3.6= 1,332mm, ~$43 per share at the 2026 EOY, which is a 166% upside from here. Using a 15% discount rate, this should be about $37.4 at the EOY 2025.

As with all biotech companies, i need to use an expected probability scenario to weigh my expected return.

I believe my upside case is still extremely conservative, because there are no multiple expansions backed into the valuation and also no considerations for what the FDA will do.

Would love feedback