Rough Idea Post#1 - InPost: European E-Commerce Logistics Winner

A growing network effect: Virtuous cycle that fuels greater economies of scale

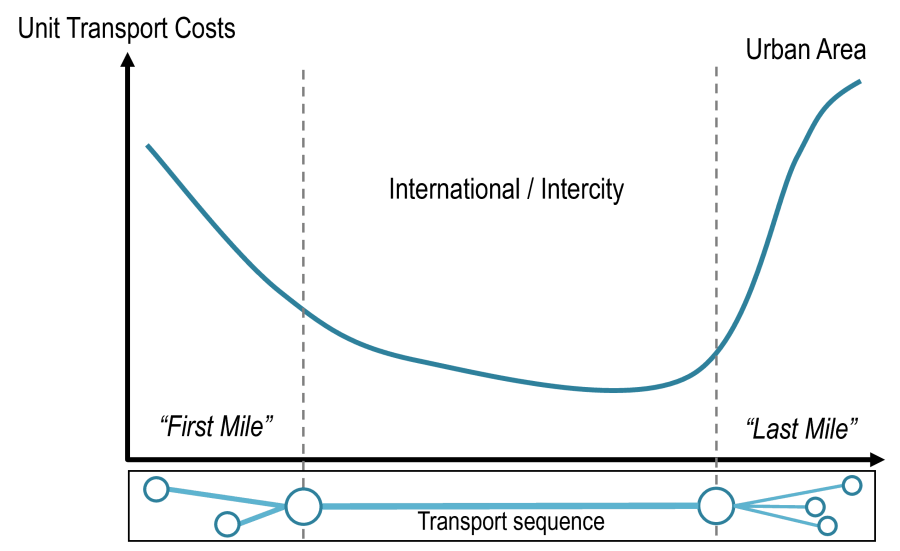

E-commerce logistics is a complicated operation. Every day, millions of parcels are transported through a network of logistics providers. The most painful part of logistics is what is known as “Last Mile Logistics”, from the distributor to the consumer. An estimated 41-53% of total transport cost is incurred here.

These costs arise because of traffic jams, failed deliveries and a myriad of reasons etc. So why do the other parts of the parcel’s journey not cost as much? It is simply because the transportation costs are spread across a larger bulk of parcels.

So what does InPost do differently?

InPost is the last-mile logistics provider for E-Commerce platforms.

Instead of delivering to the customer’s doorstep, they deliver to the closest Automated Parcel Machine (APMs)/ locker near the customer. Thus, the delivery driver can drop off a large load of parcels at once, rather than waste time - stopping at each house and dropping off an individual parcel. Then, the retail customer can pick up their parcel within a stipulated time.

This is the service that InPost provides, but it is not what InPost is entirely. InPost owns the sorting hubs and APMs but it outsources transportation to external parties. This business model was perfected in China, with most major logistics players like ZTO express and YTO express optimizing this model to the extreme. However, InPost is the most prominent player for this business format in Europe.

Overall, the advantages that InPost gets are 1) Lower delivery costs, 2) Network effect, 3) Flexible Business operations.

1) Lower Delivery Costs

Merchant costs for parcel delivery are estimated to be 25-30% lower. Lower delivery costs arise from more efficient last-mile logistics operation.

2) Network Effect

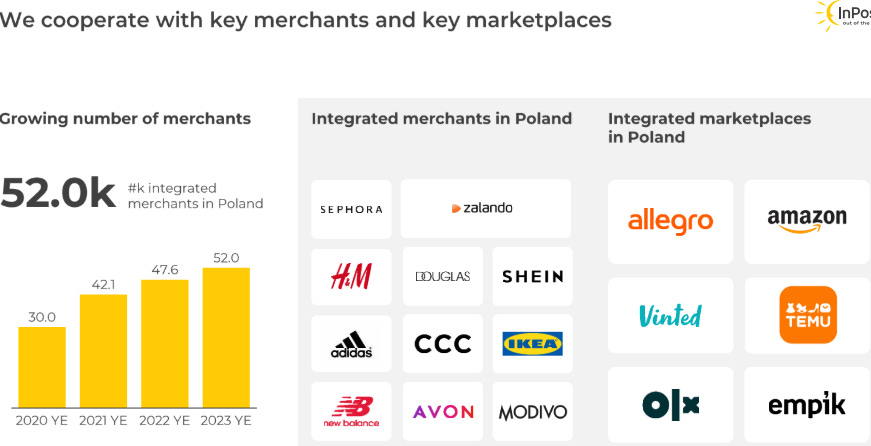

InPost’s network effect comes from the increasing accessibility of its APMs and lockers, which improves its user catchment. Lower delivery costs attract customers and merchants. The rising customer and merchant base, in turn, attract more customers and merchants, driving more parcel volumes, and improving economies of scale.

It’s success in Poland shows how scalable its business operations are. Of course, we must attribute part of its success to Covid’s acceleration of E-Commerce adoption.

A more in-depth look into their APM deployment (not counting their lockers) shows that the operating leverage achievable once a certain utilisation rate is achieved. But as their utilisation rate parcel volume per APM stagnates at about ~22k, adjusted EBITDA margins stabilise between 40-50% adjusted EBITDA margins.

3) Flexible Business Operations

Another point that InPost has as an advantage over other logistic operations is that InPost uses external services for the transportation of parcels. Having a large dedicated labour force becomes a drag when there is insufficient volumes. This can be seen in the poor profitability of FedEx and other European logistics operators.

Moat

These are all features of InPost’s business that I like. The main moat for InPost is the capital-intensive nature of establishing all the parcel lockers and APM throughout the country. This moat is available to InPost because it is one of the first movers in Europe. They are still competing with e-commerce giant Amazon in other parts of Europe.

I would think that another moat is the user stickiness of InPost after consumers get familiar with their platform.

Risk

The key risk I would have is that Amazon uses its influence on online merchants to use exclusively Amazon lockers. But I think that the EU prevent it as that can be considered monopolistic practices.

Overall Thoughts

Overall, I really like the business model. The Poland segment is close to maturity, and then we can see InPost invest its massive cash flow into its France and UK segment.

Not to mention, it has an ESG-friendly narrative, reducing overall carbon emissions.

Please feel free to share your comments. This is a rough idea post.