Executive Summary

InPost is a Poland-based third-party e-commerce logistics provider. They have operations across Europe, predominantly Poland, France, UK & Italy, and to a lesser extent Spain, Belgium, Portugal, and the Netherlands. With E-commerce slowly becoming more pervasive in consumers’ retail spending habits, I find there is a compelling growth story for InPost, given its superior operational approach to E-commerce logistics as a whole, with a defensible moat due to the capital-intensive nature of its business.

Company Overview

What does InPost do differently?

As mentioned in my previous post, e-commerce logistics has faced the “last-mile logistics” problem, where the delivery from the distribution warehouse to the door of the customers accounts for 40-60% of the total logistic costs of the parcel.

Industry Dynamics

After I dived deeper into InPost, I learned that the InPost parcel lockers (or Automated Parcel Machine - APM) fall under the Out-of-home delivery market in Europe.

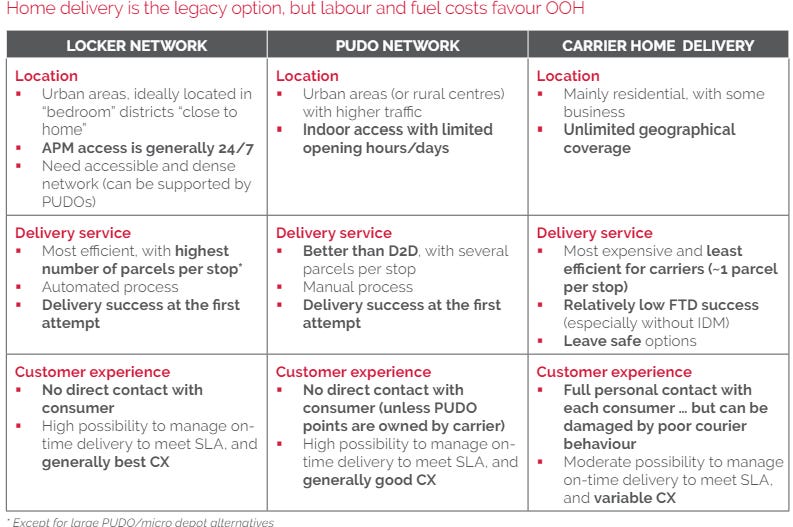

Compared to Doorstep delivery, the direct competitor to APM is the traditional Pick-Up-Drop-Off (PUDO) point. In Europe, traditional PUDOs are places where packages can be picked up. This can be a small (convenience) store, a parcel shop, or a depot/micro-depot.

“OOH allows the consolidation of shipments, which increases delivery and pickup efficiency and can reduce delivery costs. It reduces the use of resources (cars, couriers) and increases the efficiency of delivery processes (as dropping off more parcels at the same location means fewer stops are required and eliminates unsuccessful deliveries where recipients are unavailable).”

OOH is a win-win-win scenario for the Consumer, Merchant and Carrier.

OOH is a win-win-win scenario for the Consumer, Merchant, and Carrier.

For Consumers, OOH is convenient as it allows consumers to pick up their parcels at any time (24/7) compared to Doorstep delivery, where consumers have to wait at their homes to receive the parcel.

For Merchants, parcel delivery to parcel lockers is generally a safer mode of delivery than Doorstep because the delivery to set parcel locker locations like OOH points reduces the chances of missing parcels. The return delivery process is also much simpler for merchants and consumers alike.

For Carriers, operating OOH points significantly improves unit cost economics for the carriers, as it solves the last-mile logistics problem.

The main problem for OOH points is that OOH points do not cover all the geographical points like Doorstep deliveries —> Limited coverage

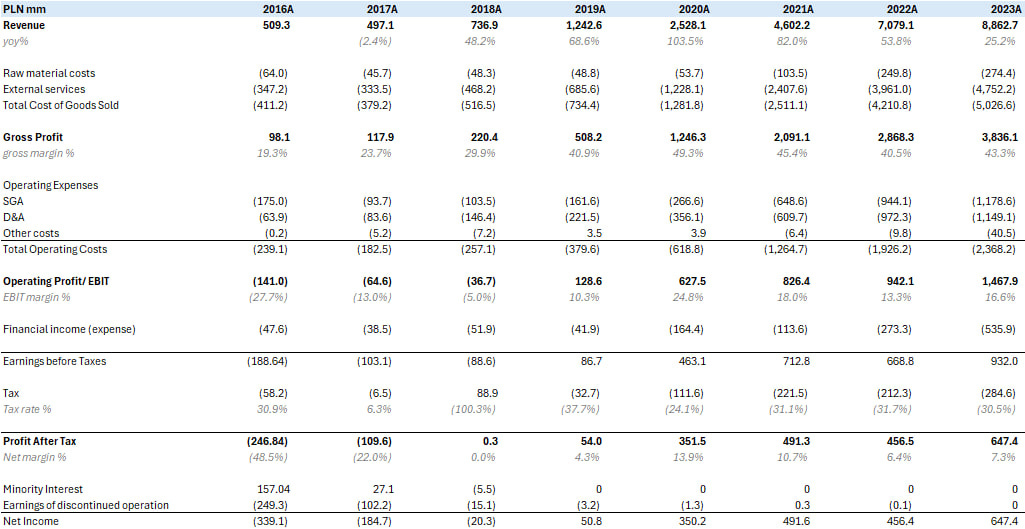

Financial Performance

Before InPost acquired Mondial Relay in 2021, InPost achieved an impressive 4-year revenue CAGR of 38%. The margin inflection in 2020 was further bolstered by low oil prices, which increased gross margins from 41% to 49%.

Operating Segments

Currently, InPost has 3 operating segments - Poland, Mondial Relay (France & Others) and Other International (UK & Italy).

History & Management

1999- Integer.pl Group - now InPost - was founded in 1999 by Rafal Brzoska to distribute leaflets.

2006- Back then, in Poland, only the state-owned postal operator Poczta Polska was allowed to deliver mail below 50 grams, so Rafal decided to add 50g metal plates to the mail, effectively bypassing the state monopoly on postal service. As a private company, InPost was able to operate more efficiently than the Poczta Polska, offering competitive rates for the same products.

2007 - InPost’s mail volumes had grown immensely, launching a letter tracking system via the internet.

2009 - The idea of parcel lockers came about. These lockers were capable of receiving and sending parcels 24/7. InPost begins offering parcel locker services.

2014-2016 - IPO’d on the Warsaw stock exchange. InPost was on the verge of bankruptcy after a rival company started a price war.

2017 - An angel investor, Advent International, acquired 90% of InPost - paid off US$110 mm of debt and gave Rafal another US$125 mm to double InPost’s parcel locker network to 4.4k in a year. InPost also started expanding into the UK.

2018 - InPost received a $145 mm loan from KKR to continue expanding their parcel network. KKR liked the machine-by-basis unit economics, citing the payback period to be “as low as 1.5 years per machine”.

2021 - InPost went public on the Amsterdam Stock Exchange. InPost also acquired Mondial Relay, the leading French E-commerce, out-of-home parcel delivery platform. The acquisition allowed InPost to become Europe’s leading out-of-home automation solution for e-commerce, with access to France, Benelux and Iberia’s markets.

Furthermore, InPost managed to maintain a grip on the Polish E-commerce logistics market, after it signs a contract with Amazon for 5 years till 2026 in Poland.

Investment Thesis

Core Competencies of InPost

“Why have parcel lockers achieved such enormous success and gained increasing popularity?

The answer is simple: they perfectly meet the needs of today and keep up with the dynamically developing e-commerce sector. These innovative devices allowed us to easily solve a number of problems, such as: long waiting for the courier, the need to stand in queues, collecting parcels only at specific hours and at designated points. Moreover, using Parcel Lockers is profitable in terms of price.”

To further understand why InPosts wins, we need to dive deeper into the unit economics of the different last-mile logistic outcomes.

Difference between PUDOs and APMs

While PUDOs and APMs are both OOH, the costs associated are rather different. For this, I will study Mondial Relay’s data to understand the differences.

For PUDOs, most of the costs are variable. For APMs, most of the costs are fixed. Deploying APM is capital-intensive. Based on my calculations, the annual depreciation APM is around 20k PLN. Based on their useful life accounting policy, the useful life for an APM is 8-10 years. So a single APM is around ~ 200k PLN (~50k USD/~47k EUR).

I define general logistic cost (in my calculations above) as the cost for external services such as the delivery service between distribution centers and the APMs. Thus, I am assuming that such costs are uniform per parcel whether or not it is fulfilled by PUDO or APM. In 2023, the average revenue per parcel was ~12.2 PLN, and the general costs per parcel were PLN 8.3. This roughly equates to 32% gross margins. This is without adding in COGS-specific to PUDO and APM.

Other operating expenses per parcel come from Sales & Marketing, Call Centres, IT Maintenance and other general costs(I excluded M&A-related costs as I believe it to be a one-time expense). It has risen from 0.74 PLN in 2022 to 0.94 PLN in 2023. I find the rising operating costs would be due to InPost’s efforts to gain consumer mindshare in France and promote their APM locker network.

For PUDO points, the operator gets a commission fee (~1.78 PLN) for each parcel received. This puts the gross margins for PUDOs at 2.13 PLN, ~17.4%. And we can see that that has been consistent for 2022 and 2023. Thus, the margins are relatively fixed and are unlikely to change. Further considering operating costs, the operating margin for PUDOs is 9.7%.

For APM points, the main cost is depreciation - which is ~20k PLN annually. The other operating costs include rental and electricity costs of the APM, which are variable. Theoretically, such operating should be considered fixed, but as seen from the calculations, the operating costs per parcel for APMs did not change significantly, from 0.56 PLN to 0.54 PLN when parcel density increased to 6,789 from 5,820. On the other hand, D&A costs per parcel were lower, as it was spread across a larger number of parcels. We can see that gross profit and margins for APMs, excluding D&A, were 3.36 PLN and 27.5%. However, as the parcel density for APMs is relatively low compared to the Poland segment, gross profit and margin inclusive of D&A were (0.39) and (3.2%) respectively.

Operating margins will begin becoming positive once annual parcel density hits ~9,000. Any further increase in parcel density becomes pure profits. The final predicted operating margin of 11.7% in the last scenario is likely to be severely underestimating future operating margin because of my assumption that operating costs (Sales & Marketing, IT Maintenance, Call Centre, etc.) are variable. In this case, I assumed it is variable because Mondial Relay is in a growth stage - operating costs are likely to grow at the same pace as parcel volumes. But once Mondial Relays hits critical mass/maturity, operating costs are likely to grow slower than parcel volumes. So there is a further degree of operating leverage

From studying Mondial Relay, we can observe a higher degree of operating leverage for APMs when parcel density rises. For PUDOs, while the operating margins are high from the start, there is no room for margin improvement as almost all the costs are variable. This is the key difference between PUDO and APMs.

Difference between APMs and Doorstep Delivery

Studying Poland’s operations, the key differences between APM and Doorstep delivery are 1) Revenue per parcel, 2) Operating costs per parcel, 3) Operating leverage

APM revenues per parcel are significantly competitive compared to Doorstep delivery. While we might be led to believe that this means lower revenue for InPost, this competitive pricing has allowed the growth of APM parcel volumes to vastly outstrip that of Doorstep delivery parcel volumes.

This competitive pricing is only possible because of the significantly lower unit costs per parcel. Unit costs are lower as APMs solves the last-mile problem. We can see that APM unit costs per parcel were 4.54 PLN compared to the Doorstep delivery unit cost of 7.73 PLN.

The inflection point for Operating leverage was achieved between 2019 and 2020 when the operating margin for APM increased from 9.7% to 27.0% once the annual parcel density per APM increased from 14,000 to 22,000. This jump in parcel density was catalysed by Covid-19.

Competition within its 3 Major Segments

Competition for InPost are either pure-play logistics companies like DHL Express or E-commerce players like Amazon and Allegro.

Poland

The Polish space is the most important for InPost as it is their home market. Within Poland, InPost is the dominant parcel locker play with 19.3k APMs deployed (22k according to InPost 2023), a massive 66% of the total APM market share, compared to the next top player DPD with 3.3k APMs with 11.3% APM market share.

However, if we were to include PUDOs and APMs, Allegro would have the highest number of OOH points. Allegro is the dominant E-commerce platform in Poland with ~38% market share. No other player is remotely close.

Allegro is one of InPost’s largest customers, representing 18.5% of InPost’s total revenue. In theory, with Allegro’s OOH distribution points, they could operate without needing InPost’s network. In reality, both companies have been cooperating to be able to focus on their competitive advantage.

InPost’s has a special relationship with Allegro. Recently, they signed an agreement that reduces the extent of price hikes for Allegro and increases parcel volumes for InPost. Thus, we can infer their symbiotic relationship.

“The Group has entered into a long-term framework agreement with InPost for the delivery of parcels to lockers. This agreement runs to 2027 and the Group has recently been increasing the scope of cooperation with Inpost and has been able to negotiate discounts versus the long-term agreement for calendar 2024” Source: Allegro 2023 Annual Report

InPost’s superior and hard-to-replicate logistics network needs Allegro’s large volume to be profitable. Correspondingly, Allegro’s E-commerce dominance needs InPosts’s cheaper services to be maintained.

I find their dominance within Poland will continue to crowd out their competitors from reaching critical mass. Thus, their hold on the Polish Market will continue to grow. Currently, InPost has an estimated ~45% market share and I expect it to continue to grow.

Mondial Relay - France

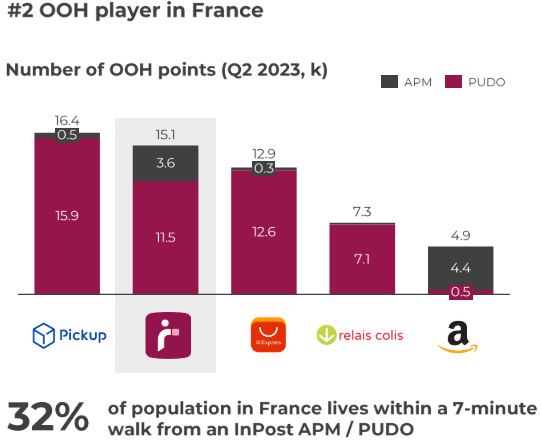

Mondial Relay was acquired by InPost in 2021. Since then, InPost has been expanding its presence in France and other countries.

Initially, Mondial Relay only had PUDO points. After being acquired, InPost began installing more APMs. All OOH points are increasing except France’s PUDOs, which started declining in Q4 2022. I would infer that InPost is converting existing PUDOs to APMs. This would drive greater parcel density rates for their APMs. Meanwhile, Mondial is quickly expanding its international segment by increasing PUDOs as it is less capital-intensive than APMs. Looking at the difference in APM growth rates between France and Other Markets, InPost is likely looking to secure its position in France before aggressively deploying its APMs in Other Markets.

Mondial Relay is present in a few European countries. Among them, France is the most important market. As of the end of 2023, Mondial Relay has deployed 5.3k APMs, of which 4.5k are in France. (The data in the report may be inaccurate)

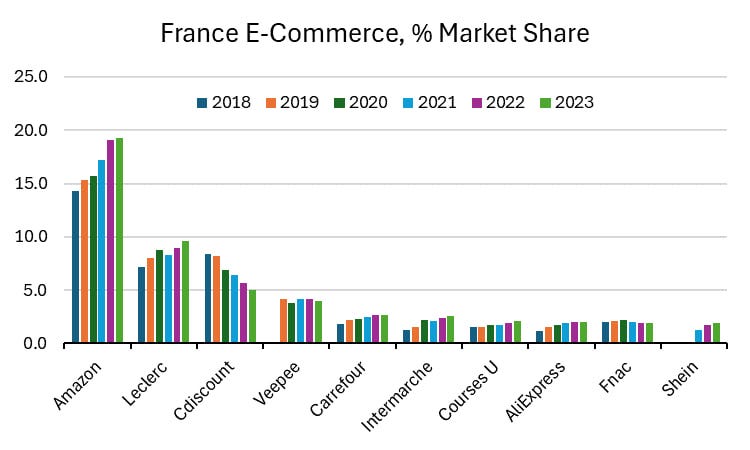

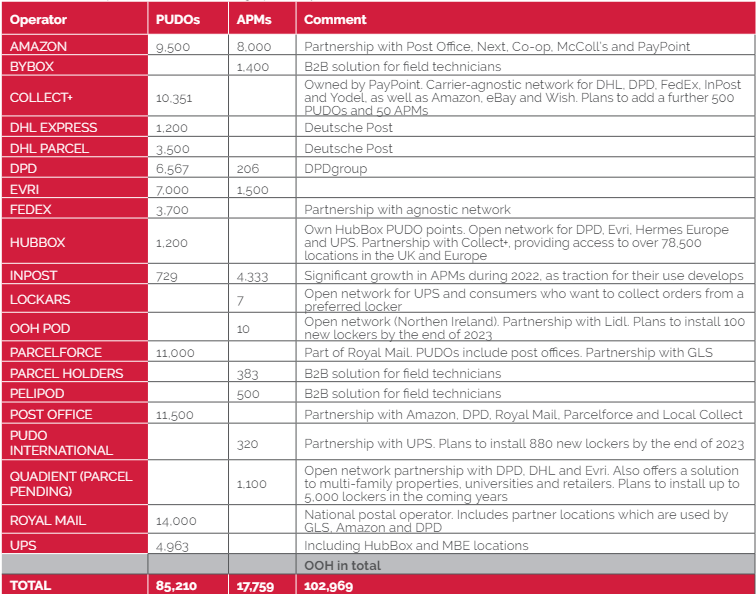

Following the OOH Delivery Europe report 2023, La Poste has the largest OOH network, but Amazon leads in APM numbers, which is a closed network. They only provide service to Amazon customers.

While Amazon is the largest E-commerce platform in France, it does not have same level of dominance as Allegro did in Poland. The E-commerce space in France is fragmented with many more competitors. As Amazon’s APM network is closed, APM volumes would likely be sufficiently high to reach critical mass. However, the number of APMs is only 2.8k(report)/4.4k(InPost Q2 23 figure), suggesting the APM network is either extremely young or undeveloped due to higher Doorstep delivery (speculated Amazon Prime offerings) . Both scenarios would mean that InPost, which currently has a 10% market share, can compete with Amazon within France. Furthermore, with a fragmented E-commerce market, InPost can still woe the other 80% of the E-commerce platforms.

Another prominent competitor is LaPoste. La Poste is the National Postal Operator for France, 66% under Caisse des dépôts et consignations (Public Financial Institution) and 34% by the French Government. Similar to Poczta Polska, La Poste had a regulatory monopoly on letters, preventing any real competition. The problem with Public-owned postal institutions is that these organizations have no real incentive to optimize their operations. Having a regulatory monopoly removed the need to improve since it can just raise prices. I find Mondial Relay is well-positioned to gain market share in France.

UK & Italy

InPost started expanding in UK since 2017.

InPost is still expanding on all fronts for the UK and Italy. As seen from the APM expansion efforts, InPost is prioritizing the UK rather than Italy. Currently, I’ll focus on UK.

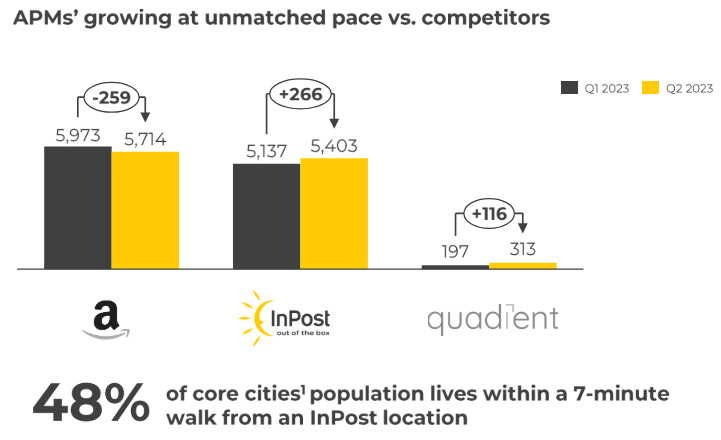

Based on InPost’s presentation, the 2 main competitors are Amazon and Quadient. Apparently, Amazon’s locker numbers fell (Not too sure about the reason). Quadient has plans to roll out 5k APMs in the UK.

In the UK, their main competitor is still Amazon. According to the report, Amazon has the largest parcel locker network, nearly double that of InPost’s.

Most importantly, Amazon has clear dominance over the UK’s E-commerce market. With its own comparatively more developed APM locker, Amazon has an edge over InPost.

Quadient is a rising competitor that is the most similar to InPost. They partnered with many other carriers and organisations. Quadient’s Open Locker Network is carrier-agnostic, while InPost is carrier-specific. The differences between these 2 modes of parcel locker networks can be found here. Essentially, Quadient’s advantage as a carrier-agnostic player is that they can grow parcel volumes drastically as they partner with multiple carriers - DHL, DPD UK and Evri etc.

Thus, InPost does face significant competition within the UK. However, InPost did manage to strengthen their logistics operation by acquiring 30% stake in Menzies Distribution. Since its exclusive partnership with Menzies, its parcel volume skyrocketed.

However, this jump in parcel volumes is likely only due to the funnelling in Menzies’ volumes into InPost’s APM network. The latest Q1 2024 results appear to show a plateau in parcel growth. On the other hand, it could be attributed to seasonality.

Regardless, InPost’s decision to invest in Menzies distribution represents an inorganic growth route for parcel volumes. Despite the tough competition, InPost managed to find new ways to grow volumes.

For the parcel locker business, reaching critical mass in volumes is the key to success.

Moat

As mentioned in my previous post, the main moat for InPost is the capital-intensive nature of deploying APM networks. It is not easy for new entrants to break into the market. Furthermore, the cost per parcel decreases drastically once a critical mass is reached, giving InPost the ability to undercut other competitors. While undercutting competitors for most businesses means poorer margins, volume growth for InPost means margin expansion due to its operating leverage, thus InPost can sustain a price war and it may even be favorable for them.

Since the inflection point between 2018 and 2020, Return on Invested Capital (ROIC) has been around the mid-teens, and can be expected to continue or grow from this point as the other segments become profitable.

Segment Financials

There are 4 key metrics for InPost: 1) Parcel Density, 2) Proportion of APMs in OOH, 3) Parcel volume growth, and 4) OOH point growth. Parcel Density is the utilization rate of APM - it has the strongest impact on margins.

Poland’s margin performance has already reached a steady state. Don’t get me wrong, parcel volumes are growing, greater than the market rate. But the critical mass has already been reached. Parcel density can increase further, but EBITDA margins are unlikely to increase significantly. The next pivot will be for EBIT margins, once the depreciation of APMs (10 years useful life) is completely off the books. (We can also observe that there is a seasonality pattern - Q4 higher volumes)

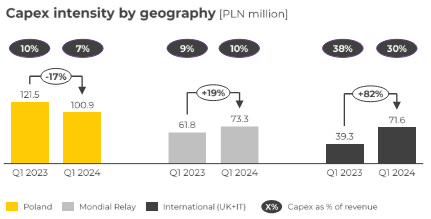

Capex intensity has already started to go down for InPost, signalling that its operation is reaching maturity. Once the capex stagnates, we will know that the capex is purely for switching out old parcel lockers (maintenance) - operations are mature. The Poland segment is already funding the expansion in its two other segments.

For Mondial Relay, Parcel Density per OOH appears to have stagnated, but this is because Mondial Relay already had a high parcel base volume before acquisition. Mondial Relay is converting its PUDO to APMs, to increase the operating leverage. However, EBITDA margins are stagnant because parcel density has yet to take off.

In Q1 2024, InPost mentioned that total market e-commerce volumes were in decline, but it still gained market share. Furthermore, FX impacted InPost negatively as the PLN strengthen against Euro. Thus, for Mondial Relay, the margin turn will come slightly later.

The Other International segment shows the margins rising as parcel density increases. Parcel volume growth has been outstanding, but part of its growth in 2023 can be attributed to the partnership with Menzies. This operation is the most nascent and will probably take the longest to become completely profitable because of the aforementioned strong competition. InPost will have to continue significant investment in UK & Italy .

Valuation

Discounted Cashflow Analysis

I think a fair share price for InPost would roughly be around EUR 18, giving us a ~7% margin of safety as the current share price is around EUR 16.7. However, I believe that I am rather conservative on the EBIT margin end.

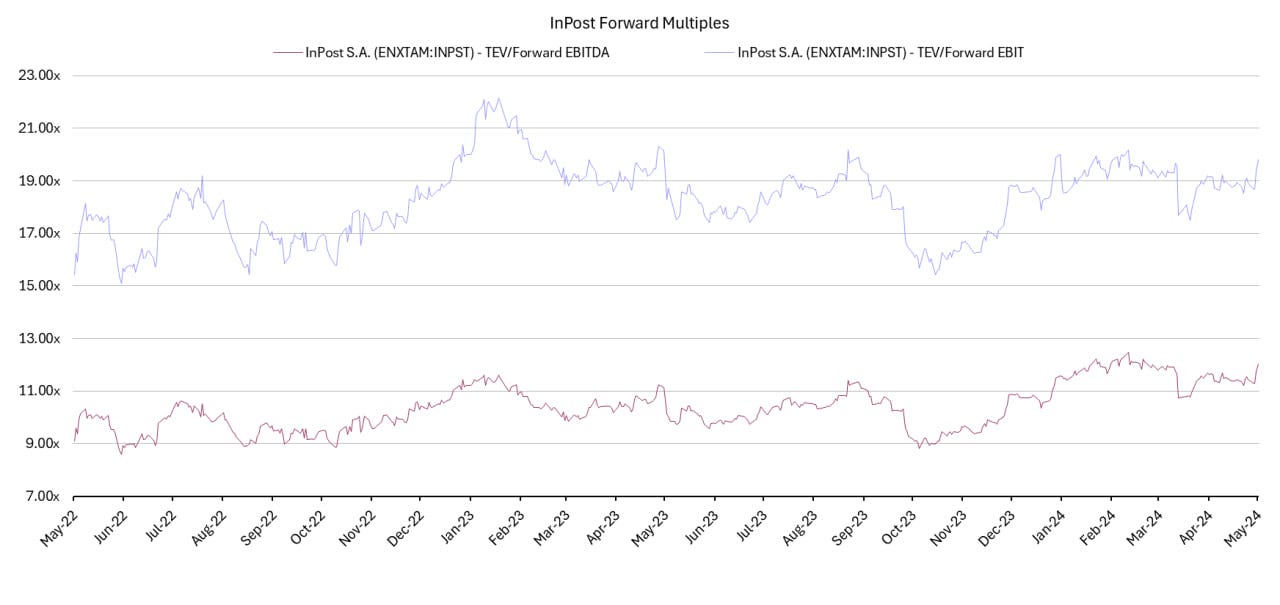

Multiples

Based on my estimates. The company trades at a 21x Forward EV/EBIT and 12x Forward EV/EBITDA.

It trades within a tight band of multiples. There might be an opportunity for a multiple re-rating once another major segment hits maturity like the Poland segment.

Closing Thoughts

Risks

I think the key risk for InPost is the major e-commerce platforms building their own parcel networks as we see with Amazon and, to a lesser extent, Allegro. If Amazon allows other merchants to use its parcel network, then Amazon can drive InPost out of business.

The key mitigating factor for this risk is Amazon has a presence in many other countries, while InPost can selectively invest significant capital into a few. While Allegro shares this edge, InPost had the first mover advantage and is already dominant in Poland.

Conclusion

While my valuation may seem like it is fairly priced, my assumptions have been conservative. Moreover, InPost has a great growth story paired with a history of strong execution prowess. InPost has a great value proposition and offers a win-win-win solution for Merchant, Customers and Carriers. So I think its a wonderful company.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett