HDSN: Severe Market Mispricing due to Seasonality

HDSN is incredibly oversold with the market focusing too much on Q4 results, flat refrigerant prices and an expected US$20 mm non-recurring revenue

Overall, I find that the market has overreacted to a lower year-on-year result comparing 2023 Q4 to 2022 Q4, which was its bumper crop year. As usual, Mr. Market misses out on the fact that HDSN is a refrigerant company which does not sell much during winter. In my opinion, there is a clear mispricing opportunity. As of my writing, HDSN is down 10% pre-market trading the day after the earnings call.

Q4 Earnings Takeaway

Negatives:

1) 20 million of the 2023 DLA revenue was related to increased DLA specific program activities that may not be repeated in 2024 - Less government revenue that was of higher gross margin (The whole DLA - 53mm - provides about ~1-2% additional margins)

2) With the current pricing structure in 2024, we do expect to operate much closer to the 35% gross margin expectations we have previously communicated than the 39% we achieved in 2023 - Reiterated 35% gross margins

3) Pricing pressure with the price of certain refrigerants remaining consistent or in some cases slightly below where we were when we exited 2023 which is well below the price we saw in the first quarter of 2023 - Pricing to remain flat for Q1 2024

Positives:

1) EPA issued a proposed rule that addresses the use of reclaimed refrigerant, which we require to be promulgated as part of the AMAC legislation. Assuming the final rule looks similar to the proposed rule, we will have the first ever federal requirement for the mandatory use of reclaimed refrigerants relative to specific sectors of our industry - Mandatory use of reclaimed HFC might be coming this summer

2) While Hudson is well prepared for more stringent regulatory environment, some of our competitors may find it difficult to comply with the new requirements, creating potentially attractive acquisition opportunities. - Competitors may struggle to provide sufficient HFC due to lower refrigerant supply, allowing HDSN to acquire them cheaper

3) As we continue to generate additional cash flow in 2024, we expect to one, ensure we have adequate inventory on hand, two, review any possible M&A opportunities, and three, consider potential share buybacks - Shareholder return policy finally stated clearly

4) We do think that prices would be up in 2024 because of the reduction in the availability of a virgin production and consumption - Price of refrigerant is expected to be up once the selling season starts, which Spring going Summer

Thesis: EPA's drawdown in Virgin Refrigerant Supply switches HDSN's refrigerant mix to favor the higher margin reclaimant business

HDSN does not disclose the mix of virgin-to-reclaimed refrigerant gas that they sell. However, we have their market share data which claims a 35% market share in their investor presentation deck Nov 2023.

Assuming their market share data is accurate, for 2022, their ODS volumes and HFC volumes are about 2.3mm lbs and 3mm lbs respectively. With an average price of US$30/lb for ODS and US$14/lb for HFC, this translates to roughly US$110mm in revenue for HDSN.

Taking US$319mm and subtracting the RefrigerantSide Services revenue of US$6mm and US$110mm in reclaimed gas revenue, the virgin gas business was about US$207mm in revenue in 2022. Using the same U$14/lb for HFC, the virgin HFC volumes are about 14.8mm lbs.

Considering the further drawdown in HFC supply from 90% in 2022-2023 to 60% this year, virgin HFC volumes will drop by 1/3, which will be replenished by reclaimed gas.

From the investor deck, we know that reclaimed gas is a higher gross margin business (stated to be 50% gross margin) and virgin gas is only 20% gross margin.

This shift in the refrigerant mix will ultimately improve HDSN's gross margins. Furthermore, we haven't even considered an increase in customers as the EPA drawdown is an industry-wide regulation.

One argument that the bears might make is that gross margins are going to compress because prices of refrigerants fell from 2022-2023. My rebuttal to that would be observing the past 3 quarter's performance in comparison to 2022.

(I scrapped these numbers from the earnings call transcripts - so these may not be the most accurate figures)

According to the 2023 Q3 earnings call transcript, management stated that the average HFC price fell by 17% over than 9 months compared to 2022. Despite this drop in prices, overall gross margins remained strong, maintaining around 40%. One important thing to note is that for 2022, management emphasized that they had abnormally high gross margins partially due to their use of FIFO accounting - which essentially means they bought virgin refrigerants for a low price and sold them off significantly higher. Inventory prices began to moderate from Q3 2022 onwards. So in 2023, going by FIFO inventory accounting standards, HDSN's virgin gas business supposedly had a lower-than-average gross margin because it bought inventory in 2022 (when prices were higher) and sold it in 2023 (when prices were lower). Even with this, gross margins remained between 38-40%. This alludes to the reclaimed refrigerant business being significantly higher in gross margins than management claimed. (The other possibility is that HDSN is already majority reclaimed gas, but based on the calculations above, I believe this to be unlikely)

I feel this point is justified because looking back in 2018 (page 11/18), management had already stated that the reclaimed refrigerant business was 50% gross margins, not factoring in the recent price hikes from 2021-2023.

Moreover, the 30% drawdown in virgin refrigerant supply is more likely to hike HFC prices rather than depress it.

The following are my estimates:

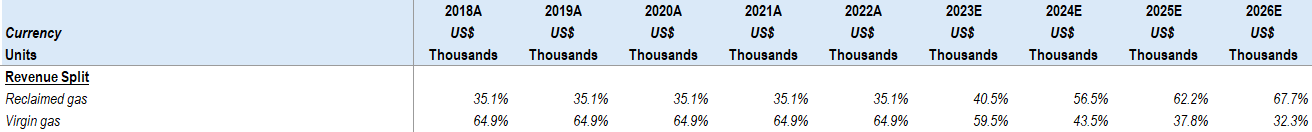

The key driver for my thesis is the switch in refrigerant mix, favoring the reclaimed gas business.

Valuation

I will not be using relative valuation for HDSN, because there are no companies similar to HDSN's profile as a market leader in refrigerant reclamation.

Based on my own estimates, on 3rd March 2024, HDSN traded at US$14.56/share, giving me an implied Forward 2024 P/E of 7.5x.

Using HDSN's 2023 Q3 results, HDSN is essentially debt-free with a small cash balance of US$3mm, thus HDSN's EV is ~US$660mm, giving me an implied Forward 2024 EV/EBIT of 6.6x.

Currently, the market forecasts 13.24x Forward P/E, which would give me a target price of over US$26 per share. The market also forecasts a Forward EV/EBIT of 8.5x, giving me a target price of US$18.70.

With these two valuations, my target price for HDSN is US$20/share.

Catalyst

The catalysts would be the upcoming two earnings call.

1) Q1 2024 earnings release (May) - We will get to see the first impact of the EPA drawdown. Expect management to talk about May's refrigerant prices.

2) Q2 2024 earnings release (Aug) - Peak selling season of Summer > Expect margins to beat the management's expectations.

I believe management tends to be more conservative because looking at 2021 annual earnings call, they guided for 30% gross margins. (" As we move through 2022, we expect gross margin performance and full year to be in the lower end of the 30% level")

Risks

The key thesis-breaking risk would be the repealing of EPA's legislation on HFC drawdown. However, I find this unlikely as this has been part of EPA's master plan. Back in 2013, management already expected HFC production to be capped.