This is some of my older work. I did this last year in October 2023, so my apologies for the outdated information.

1. Executive Summary

Cintas is an operationally well-run uniform rental company that dominates its competitors in the Uniform Rental space. It mainly sells to enterprises from the healthcare, hospitality, foodservice, manufacturing, and construction industries.

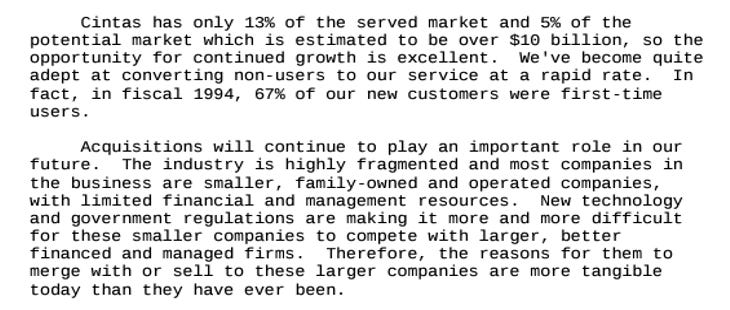

From its 1994 AR, it has highlighted that acquisitions will continue to play an important role as the industry is fragmented. Many companies within the space are small family-owned and operated companies, making them an easy target for acquisition.

The fixed assets needed are the large laundry and drying machines. Thus, the larger the business is, the greater the economies of scale as Cintas spreads the overhead costs across a larger service base.

Since 1989, Cintas has had only 3 years where revenue dropped (2009, 2010 and 2014). 2009 and 2010, Cintas was feeling the impact from the fallout of the 2008 Global Financial Crisis, which disproportionately impacted uniformed-workers - ~2/3 of the workers laid off were blue-collared workers. 2014 was the year they ended their document management business – Core uniform rental revenue was still up but ancillary revenue took a hit.

Thus, I find that Cintas is an extremely defensible business with steady and healthy growth prospects.

2. Business Overview

Cintas is a primarily US-based (Canada as well) company that provides basic backend services - mainly uniform rental - for healthcare, hospitality, foodservice, manufacturing, construction companies. They also provide other facility services, first aid & safety supplies and training and Fire protection items rental.

CTAS makes its revenue through providing route services for the following 3 segments: Uniform Rental & Facility Services, First Aid & Safety Services and Others.

Uniform Rental & Facility Services

Typically, the rental companies charge between US$4-15 a week per employee. Cintas was estimated to charge around US$1-2 a day per employee. Working days in a year was around 260-270. Every week, the delivery vehicle will pick the soiled garments and drop off the previous weeks clothes. As seen above, Uniform is still the main backbone of the business, contributing 38% of revenue. Uniform Rental has a payback period of 20 weeks has a useful life of about 1.5 years. Their uniforms are typically 65/35 polyester cotton.

As for Facilities service include simple services for the Floor, Restroom, Supply Closet, Kitchen, Shop and Onsite services. All these services entail resupplying cleaning agents, restocking necessities and cleaning services.

Sale of items from their catalogue on route is also included inside this business segment. It mainly entails any last-minute purchase of goods by the customer’s purchasing manager.

First Aid and Safety Services

Cintas offers re-supply services for First Aid and Safety products. Additionally, they provide corporate training courses for these products. This helps the customer with compliance adherence.

Others: Fire Protection & Uniform Direct Sales

Cintas provides a slew of Fire protection services and Fire-resistant clothing. For the fire-resistant clothing, they allow customers to customise the attire’s attributes.

Key Selling Points

Overall, I believe that the key selling point in terms of product differentiation for Cintas is that they provide an all-in-one service for the companies in terms of backend office supplies and compliance. Every workplace that requires workers to be in uniform has a certain degree of work risk and thus Cintas has managed to expand into that segment. They have had tremendous success in up-selling beyond their original Uniform Rental business.

However, I think the most important factor is still cost of the product. I will elaborate more on the cost side further in the competitive factors segment.

3. Industry Growth Potential

Source: Unifirst FY2022 Investor Presentation

The main uniform rental and purchase market is determined by the number of blue-collared workers requiring uniforms. The current market is estimated to be ~US$40 bn.

There has been a shift over the last 20 years. Previously, the customer split was 70 manufacturing -30 service, whereas now its 30 manufacturing-70 service.

The main mode of growth for the industry comes from converting “no-programmers”, which are businesses that use uniforms but do not rent. This may cannibalise the Uniform Sales segment, but the Uniform Rental grows more.

The industry is estimated to grow at ~8% CAGR for the next 10 years according to Morningstar. The contracts with customers have price increases every year, but I do not know the amount. From Cintas’s latest FY23 10-K, 60% of the revenue growth came from these “no-programmers”.

4. Competitive Landscape

Key Competitors Overview

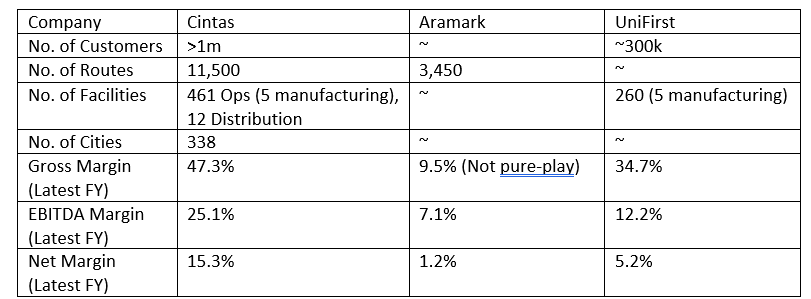

The Uniform Rental and Facilities services industries is a fragmented industry with 3 main players: Cintas (~18%), Aramark (~7%) and UniFirst (~5%). The large national and industrial accounts are already taken up by the big 3, as they are the only players with the scale and logistics to service the accounts. The average customer is a business with about 10 employees and weekly facility service product spend of US$100-150.

The remaining players within the industry are mom-and-pop shops.

For the pure uniform rental market, Cintas said that it had a 13% market share in 1994. Over the past 29 years, they have managed to grow from 13% to 23% in 2023. This extreme difficulty in expansion is testament to the invisible moat that fends off players from encroaching on its market.

Competitive Factors

The key competitive factor and moat for this business is SCALE. With size, Cintas can benefit from economies of scale in both raw cost & operating efficiency of the business. The product and services provided are generally homogenous, other than intangible benefits such as convenience. Cintas continues to increases this advantage by constantly acquiring smaller players.

As seen from above, Cintas enjoys over >10% gross margin advantage against its close competitors. This is likely due to the 2 reasons:

Ø Cintas gets special prices in partnership with Uniform brands such as Carhatt, Chef Works and North Face etc

Ø Cintas also vertically-integrated, manufacturing its own uniform brand, enabling for more value to be captured (UniFirst also seems have its own manufacturing hubs, have to dig deeper here)

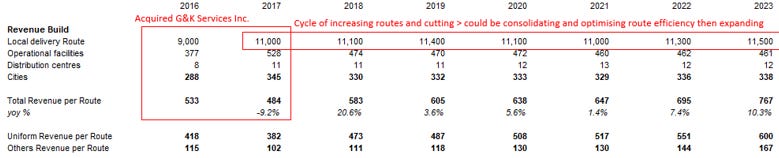

For the operating side, Cintas is extremely efficient in ensuring that it has the highest revenues per route. They appear to have this constant cycle of increasing and cutting routes over the years, which could be meant to optimise the revenues per route, thus maximising the revenue from labour and fuel costs

Another factor that allows them to do this is that it has strong sales team, which allows them to upsell their other offerings alongside the standard uniform rental package. They are a serial acquirer of small competitors.

Upon acquisition, they can increase their sales to the acquired customers, creating new value in the process. We can observe this from the 20.6% revenue growth per route 1 year after they acquired G&K services in 2017 and subsequently the more steady ~5% growth afterwards. Uniform revenue includes uniform rental and facilities services, so I believe that the growth came from the facility services portion.

Key Insights and Conclusions

It is unlikely that Cintas will be able to continue to make major acquisitions like G&K services, however small acquisitions can continue to be expected.

With their diverse product offerings, superior operational efficiencies and cost advantages, I believe that Cintas will continue to slowly snowball. All these factors explain why Cintas currently trades at 36.5x, compared to Aramark at 12x and UniFirst at 30x.

5. Financial Analysis

Acquisition Strategy

Below is an excerpt from Cintas’s 1990 annual report when they first got listed. It is stated that they looked to acquire small players. One of the largest acquisitions is G&K Services in 2016-2017.

Return on Capital

Cintas has a long history of having a high ROIC, >15%. In an industry that is deceptively simple, this is evident that there is a moat present.

I believe that this moat arises from capital-intensive barrier to entry and a cost advantage from superior operations.

Things to Note:

I expect CTAS to remain relatively unscathed during an economic downturn. CTAS’s contracts with their customers allows them to pass on some costs. Their products and services are staples for most businesses and thus they would remain less affected.

Based on the 2008 Global Financial Crisis, revenues across all segments did drop as customers laid off employees. Furthermore, according to the 09FQ4 earnings call, approximately two-thirds of jobs lost were in uniform-wearing industries, impacting CTAS worse than usual economic recession. Despite this, CTAS remained profitable and cashflow positive.

Furthermore, economies of scale help them remain cost competitive as opposed to smaller businesses. In fact, it would be ideal for CTAS to carry out their strategy of acquiring smaller competitors.

6. Valuation

Above is the P/ Diluted EPS for the past 10 years. As their stellar performance, they have become an institutional favourite as the economics of the business is clear and simple.

If we pull back the historical multiples further, we can see that the typical range of Cintas is between 25-35x TTM EPS.

Currently, at 512.63 USD per share, Cintas trades at ~37x, slightly beyond that band of 25-35x. with an LTM Diluted EPS was 13.30.

Based on Forward Estimates, Cintas trades at a 1 year Forward P/E of 35.6x.

At the current valuation, Cintas is an expensive company to own. However, for the reasons listed in the analysis above, Cintas is among the best performers in terms of quality in one of the most boring and simple businesses.